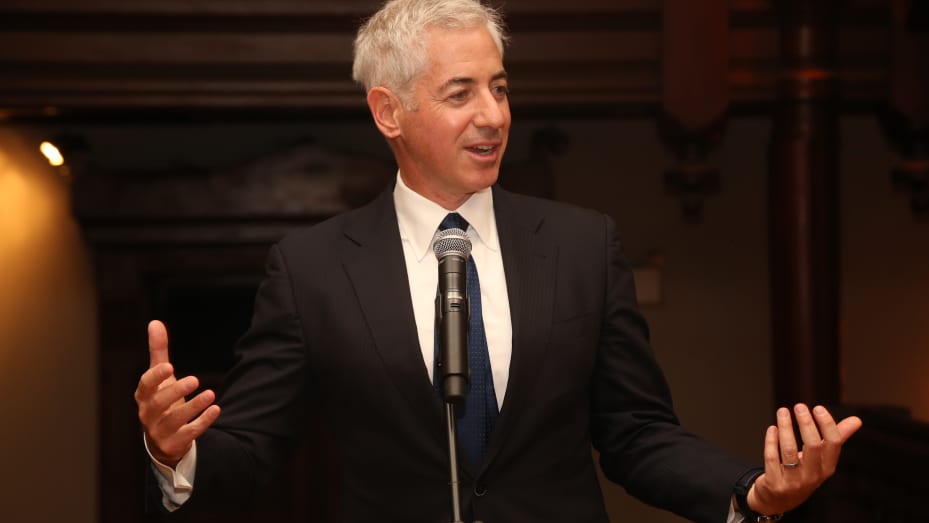

Unveiling Bill Ackman’s Approach

William Albert Ackman born on May 11, 1966, is a famous American hedge fund manager. He is the creator and CEO of Pershing Square Capital Management, a firm specializing in hedge fund management. His investment strategy has made him as an activist investor. According to Forbes Magazine , as of June 2023, Ackman’s wealth is valued at approximately $3.5 billion. In the world of investing, Bill Ackman stands out as a captivating figure known for his unique style. As the brains behind Pershing Square Capital Management, he’s not one to shy away from bold moves. Surprisingly, his investment portfolio, which is typically the collection of assets an investor holds, is made up of just eight carefully chosen stocks.

A Maverick in Action: Ackman’s Notable Triumphs

Bill Ackman is a trailblazing activist investor, celebrated for his impressive wins. One of his most outstanding victories was his savvy investment of $60 million in the struggling General Growth Properties. This move transformed into an astonishing $3.5 billion windfall. Ackman also struck gold with Chipotle Mexican Grill, a restaurant chain that experienced a remarkable surge in value under his guidance.

Cracking the Code: Ackman’s Eight-Point Investment Blueprint

With years of experience, Ackman has compiled a set of eight fundamental principles that steer his investment decisions. These guiding rules are etched in stone and help him carefully evaluate potential investments. Interestingly, amid the buzz surrounding artificial intelligence (AI), only a single AI-related stock has passed Ackman’s rigorous screening process to earn a coveted spot in his portfolio.

Revealing the Star AI Player: Meet Alphabet (GOOGLE)

Despite the AI frenzy, it’s eye-opening to uncover that Ackman’s exclusive AI pick is none other than Alphabet (GOOGL -0.27%) (GOOG -0.18%), the parent company of Google. Ackman’s bet on this tech giant signals his strong belief in its potential. His holdings include more than 8 million Class C shares and over 2 million Class A shares, collectively valued at around $1.3 billion.

Behind the Scenes: Ackman’s Tactical Moves

In a recent investor call, Ackman unveiled that his Alphabet stake was even larger than initially disclosed. This expansion was fueled by forward contracts, a financial instrument that doesn’t need to be reported in regulatory filings.

Deconstructing Alphabet Through Ackman’s Lens: A Closer Look

Let’s delve into how Alphabet aligns with Ackman’s criteria for successful investments:

- Simplicity and Predictability: Alphabet’s revenue streams, primarily from search and digital ads, are straightforward and foreseeable. Google’s search engine reliably converts online queries into digital ad revenue.

- Cash Flow Prowess: Even in challenging times, Alphabet’s cash flow remains robust. Operating cash flow exceeded $28.7 billion, with free cash flow reaching an impressive $21.8 billion.

- Commanding Market Presence: Alphabet’s dominance in the search realm is unquestionable. Google’s share of the global search market stands tall at 92%.

- Formidable Barriers: Alphabet’s AI-driven operations, intricate algorithms, and expansive data centers create significant barriers for potential competitors.

- Solid Returns on Investment: Alphabet’s ROIC of 22% outperforms its cost of capital, signaling savvy investment choices and financial strength.

- Mitigating Risks: Ackman’s focus on environmental, social, and governance (ESG) practices aligns with Alphabet’s strong ESG track record.

- Financial Resilience: Alphabet boasts a robust financial position with a net cash reserve of over $91.5 billion.

- Effective Leadership: Alphabet’s CEO, Sundar Pichai, earns high marks for leadership, as demonstrated by employee approval ratings and reviews.

AI’s Role: A Hidden Catalyst

While AI may not be the sole driving force behind Ackman’s Alphabet investment, it certainly contributes to its allure. A favorable valuation, combined with Alphabet’s alignment with Ackman’s investment principles, forms an irresistible blend.

The Bottom Line: A Golden Opportunity

Alphabet’s inclusion in Ackman’s portfolio underscores its potential for growth and success. Bill Ackman’s strategic approach, focusing on select stocks and meticulous analysis, continues to unveil opportunities that match his distinctive investment philosophy. As the investment landscape evolves, Alphabet’s AI-powered journey embodies innovation, strategic acumen, and thorough assessment.